The State of Perpetual DEXs 2025: App-Chains, Solana, and the End of Latency

Section 1: Summary

For five years, the "DEX vs. CEX" debate centered on a single excuse: "We are decentralized, so we are allowed to be slower."

In 2025, that excuse expired.

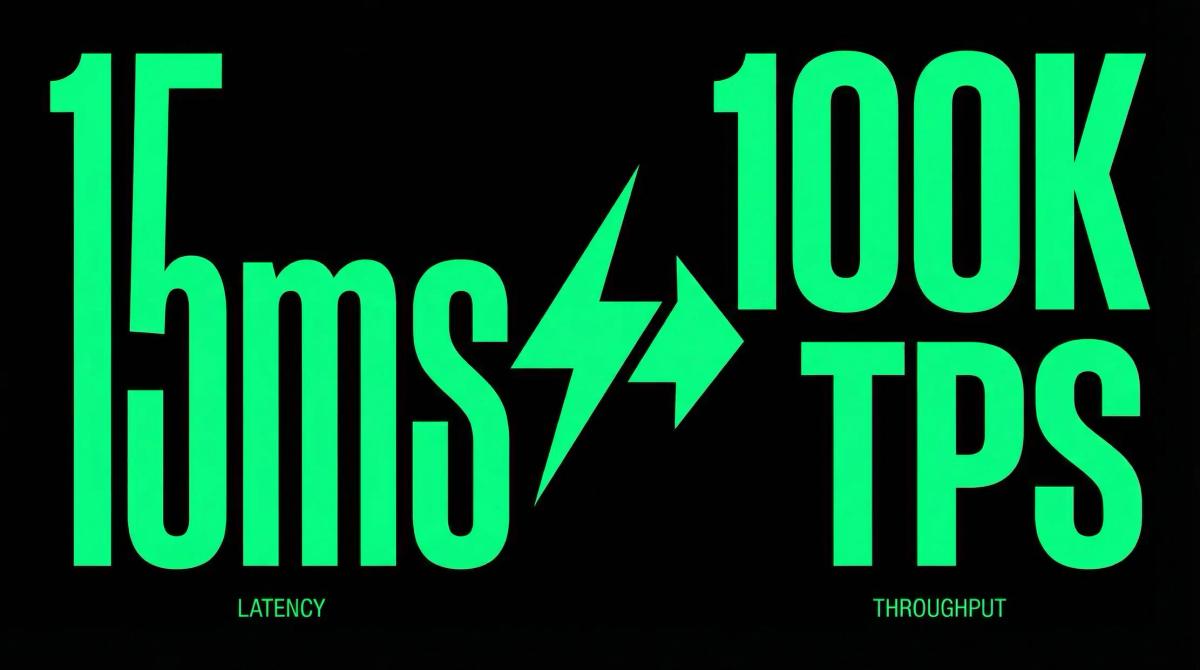

This year will be remembered as the moment the Performance Parity Point was crossed. For the first time in history, the top on-chain perpetual engines offered fill latencies (<15ms) and throughput (100,000+ TPS) that matched, and in some cases exceeded, legacy Centralized Exchanges.

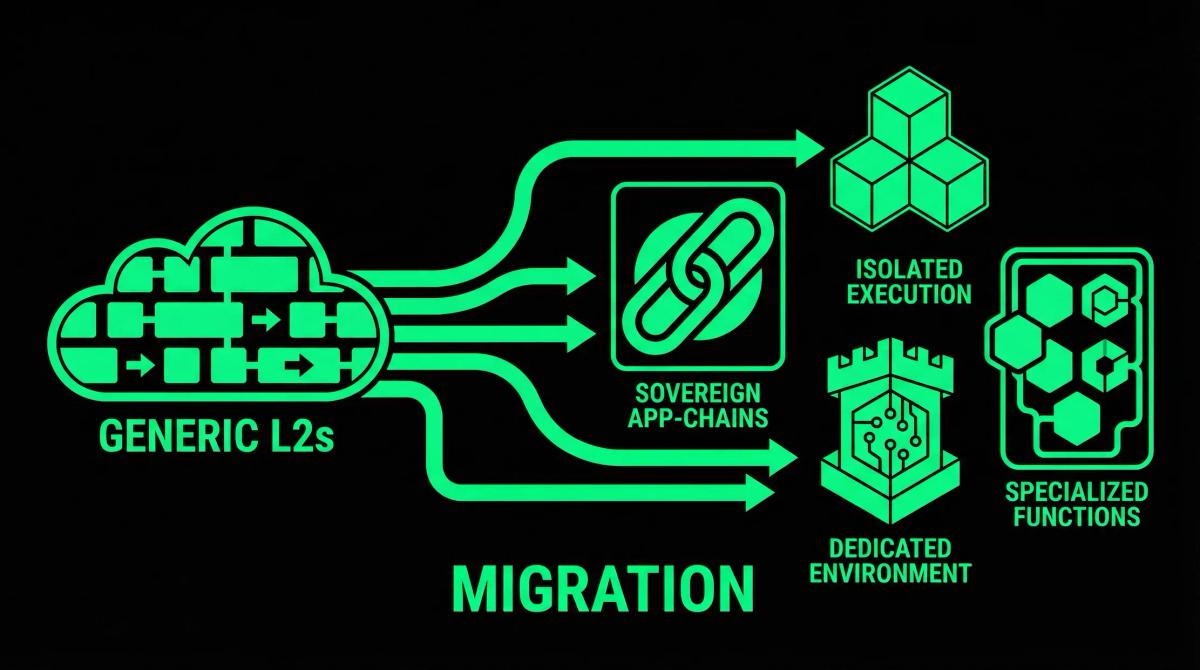

The "Order Book" won. The "AMM" for derivatives retreated to niche status. The market bifurcated into two dominant technical philosophies: Sovereign App-Chains (custom L1s built solely for trading) and High-Performance Integrated Layers (Solana).

Our Core Thesis: The "Generic L2" Perp is dead. General-purpose rollups (like Arbitrum or Base) became too congested for high-frequency trading. The winners of 2025 migrated to dedicated execution environments where they could control the physics of the block space.

Section 2: The 2025 Landscape & Evaluation Criteria

The Landscape: The App-Chain Exodus

In 2024, dYdX moved to Cosmos. In 2025, everyone else followed the logic, if not the specific tech stack.

- Hyperliquid's L1: Became the "Binance of On-Chain," hosting not just perps but spot, lending, and native stablecoins on its high-performance L1.

- Solana's Firedancer Era: With the Firedancer client fully stable in Q2 2025, Solana perps finally gained the reliability needed to court institutional market makers.

- The Death of the "GMX Fork": The "Pool-Based" model that dominated 2023 collapsed in market share. Traders demanded the precision of limit orders, not the slippage of oracle-based swaps.

The Criteria: Speed is the only Metric

We ignored TVL. In derivatives, TVL is often just idle capital farming rewards. We evaluated winners on Execution Quality:

- Glass-to-Glass Latency: The time from clicking "Long" to seeing the fill confirmation.

- Long-Tail Agility: How fast can the DEX list a trending "Meme Coin" perp? (CEXs take days; winners take minutes).

- Liquidation Fairness: Did the protocol liquidate users fairly during the "Flash Crash" of August 2025?

Section 3: The Winners Circle (Detailed Analysis)

The Market Leader: Hyperliquid (The "Binance Killer")

Archetype: The Sovereign ecosystem. 2025 Verdict: The King of Retail & Pro-Retail.

Hyperliquid is the breakout star of the cycle. By refusing to build on a general-purpose chain, they built an engine that feels indistinguishable from a CEX.

- The Good: The "Hyper-Listing" Engine. In 2025, Hyperliquid consistently listed perps for trending assets (like the AI-Agent coins) 48 hours before Binance. This attracted the "Alpha Flows"—traders who need to be first. Their "HLP" (Hyperliquidity Provider) vault remained the most profitable stable-coin yield in crypto (~25% APY), funded by real trader losses.

- The Bad: Insular. Hyperliquid is an island. Bridging out is seamless, but the ecosystem is walled off from the rest of DeFi. You are either "in" the Hyperliquid ecosystem, or you are out.

- 2025 Data Verdict: $4B Daily Volume (surpassing Kraken). Captured 60% of the "long-tail" perpetual market.

The Institutional Giant: dYdX (The "CME" of Crypto)

Archetype: The Professional Venue. 2025 Verdict: The Whale's playground.

While Hyperliquid won the "Degens," dYdX won the "Suits." dYdX v5 (launched mid-2025) focused entirely on Cross-Margining and Sub-Accounts, features that institutional trading firms require.

- The Good: Reliability. During the 2025 volatility spikes, dYdX did not halt. Their validator set is robust, and the order book depth for BTC and ETH is unrivaled on-chain.

- The Bad: Boring. dYdX lost the "mindshare" war. They are slow to list new assets and conservative with leverage limits. They are the "adult in the room," which is profitable but not exciting.

- 2025 Data Verdict: Dominates the BTC/ETH perp pairs with 45% market share. Average trade size: $150,000 (vs. $2,000 on Hyperliquid).

The Retail King: Jupiter / Solana Perps (The "Mobile" Winner)

Archetype: The Aggregator / The UX Master. 2025 Verdict: The Mass Adoption Gateway.

Jupiter isn't just an exchange; it's the homepage of Solana. By aggregating liquidity from Drift, Zeta, and Phoenix, Jupiter offered users the "Best Price Execution" without them needing to care which underlying protocol settled the trade.

- The Good: Mobile Dominance. The integration of Jupiter Perps into the "Solana Mobile Seeker" phone (the successor to the Saga) was the killer app of 2025. Users could trade perps with FaceID authorization in seconds.

- The Alpha: "Perp-as-a-Service." Jupiter allowed meme-coins to launch their own branded perp interfaces. The "Bonk Perp" frontend, powered by Jupiter, did more volume in Q3 than many standalone L2 DEXs.

- The Bad: Congestion Nuance. Even with Firedancer, Solana had moments of "Local Fee Markets" spiking, making small trades expensive during NFT mints.

- 2025 Data Verdict: 2 Million Monthly Active Users (highest in the sector).

Section 4: The Graveyard & Critical Risks

The Graveyard: The "Oracle" Models

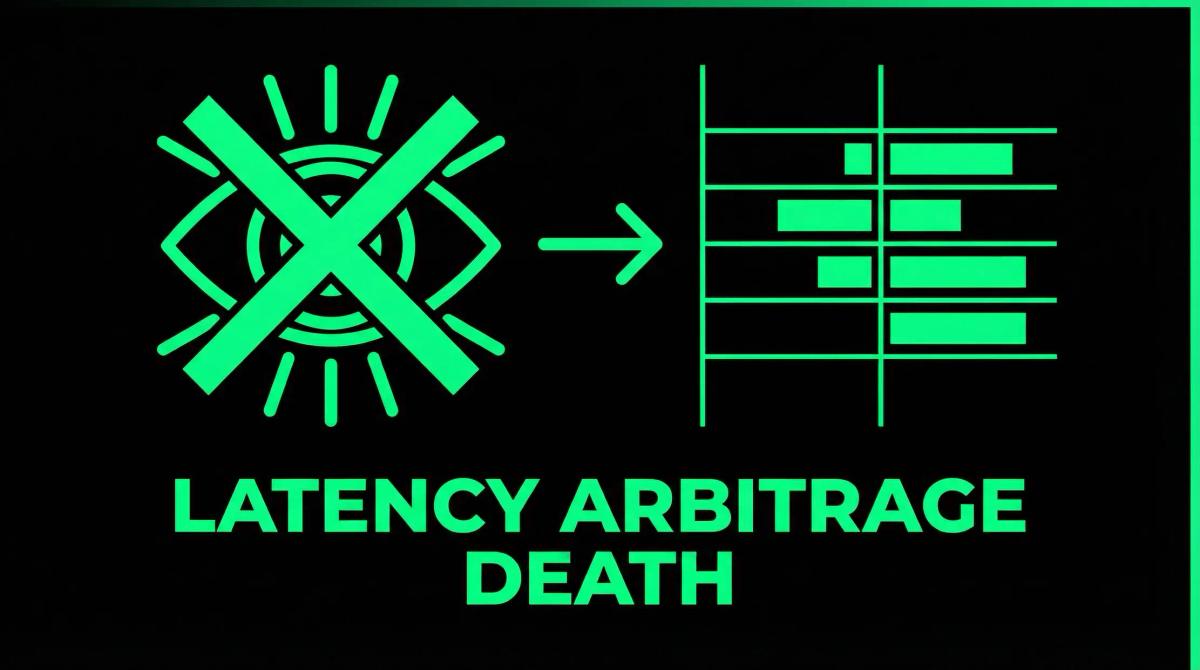

Protocols that relied on the "GMX v1" model—where LPs bet against traders based on an Oracle price—were wiped out. Why? Latency Arbitrage. In 2025, HFT firms became too fast. They could see price updates on Binance ms before the Oracle pushed them on-chain, allowing them to front-run the "Passive Liquidity" pools. LPs got drained. The market moved to Central Limit Order Books (CLOBs) because only an order book allows LPs to adjust quotes dynamically.

The Risk: Regulatory "Front-Ends"

The technology is decentralized; the access points are not. In late 2025, we saw the first coordinated "Geo-Blocking" enforcement. dYdX and Hyperliquid frontends now block 40% of the world's IP addresses.

Key Insight: The protocol is permissionless, but the website is compliant. The "VPN Gap" is the new barrier to entry for users in restricted jurisdictions.

Section 5: Outlook 2026

As we look toward 2026, the battle moves to "Hybrid Compute."

We predict the rise of "Off-Chain Matching, On-Chain Settlement" (OMOS) as the final standard. Protocols will run matching engines on centralized AWS servers (for 0ms latency) but settle the PnL to the blockchain every block.

The line between "CEX" and "DEX" will dissolve completely. You will trade on what looks like Binance, but you will sign with your Passkey, and the funds will never leave your custody.

Next Step for Investors: Stop farming "Points" on generic L2 perps. The liquidity is fragmenting. Move your capital to where the latency is. If you are a trader, test Hyperliquid. If you are an LP, look for "Market Maker Vaults" on dYdX where you can co-invest with Wintermute.